TaxBandits Simplifies your BOI Filing with an Array of Features!

We help small businesses in filing their BOI reports with FinCEN. Here are the top benefits of simplifying your BOI filing online.

-

Complete your BOI Report in a few minutes!

TaxBandits allows you to effortlessly and securely file your BOI Report in minutes and access it anytime. -

Supports various types of BOI Reports

TaxBandits allows you to create and file both an initial as well as a correction or updated BOI report. -

File a Corrected BOI Report for Free

If you need to make changes to the BOI report you initially filed, you can file a corrected or updated BOI report for free within a week. -

Receive Real-Time Status Updates

Our software will provide instant status updates on your BOI report once it is filed.

Visit https://www.taxbandits.com/fincen-boi/efile-boi-report-online// to learn more about the benefits offered to simplify your BOI Report Filing.

How Can I File My BOI Report Online for 2024?

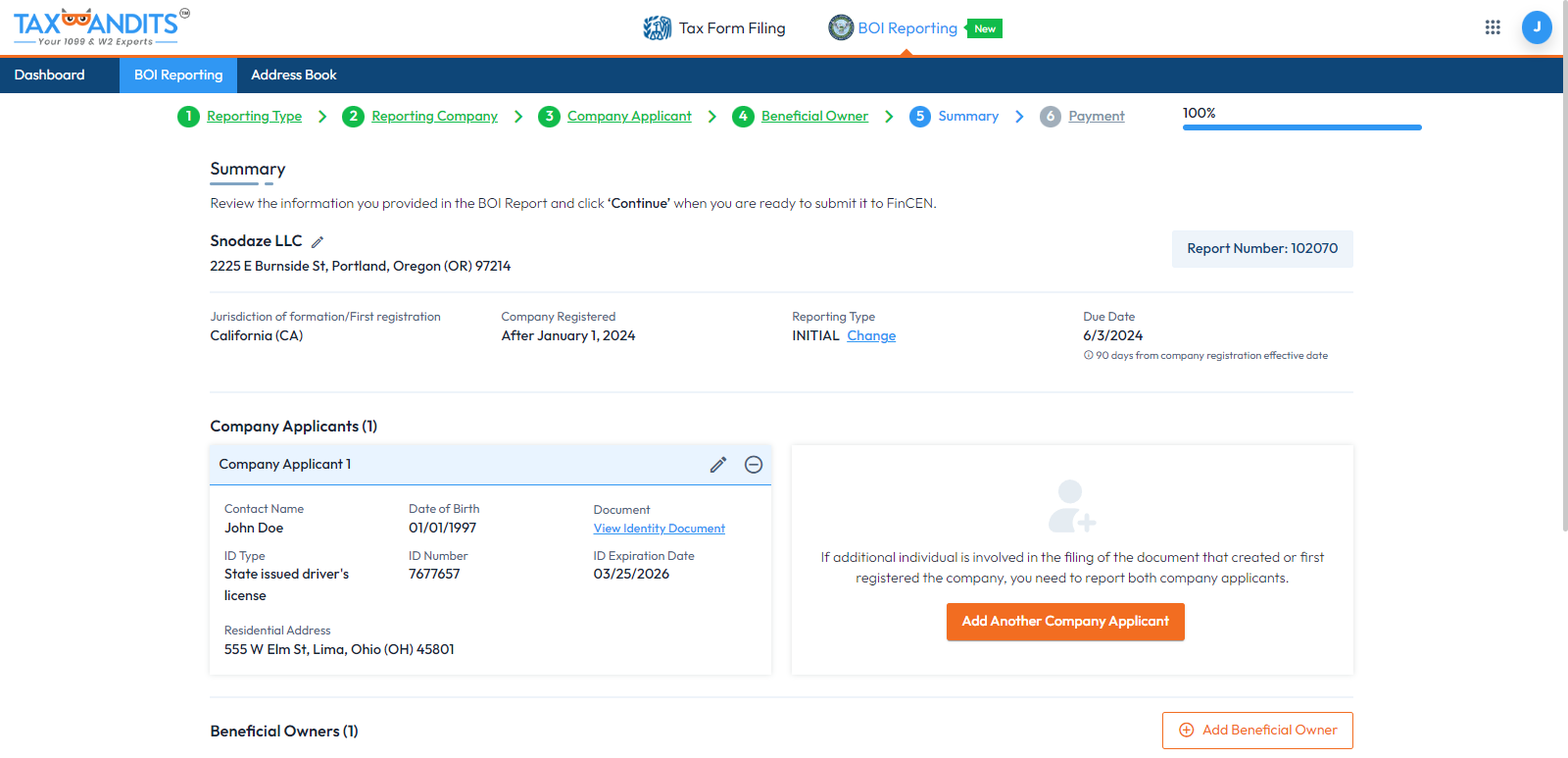

Filing your BOI report with FinCEN is simpler and more accurate with TaxBandits, our sister concern. To finish your BOI reporting, adhere to the

following guidelines.

Enter the BOI Report Information

Enter information about the company applicant and the beneficial owner.

Review and file to FinCEN.

Start filing your reports to BOI online. It will take up to a few minutes.

What Information is Needed to Submit a BOI Report with FinCEN?

To file your BOI Report to FinCEN, you must have the following details:

- Type of Report includes Initial, Update, Correct, or Newly Exempt Entity.

- Information about the Reporting Company includes Name, EIN, Address, FinCEN identifier, etc.

- Information about the Company Applicant includes name, Date of Birth, address, and identity proof.

- Information about the Beneficial Owner Details includes name, Date of Birth, Address, and Identity Proof.

BOI Filing Deadline

The deadline for filing a BOI report with FinCEN depends on when a company was created or registered.

For companies created on or after January 1, 2024, the deadline to file the initial BOI report with FinCEN is within 90 days from their creation date or registration.

For Companies created before January 1, 2024, the deadline to file the initial BOI report with FinCEN is until January 13, 2025.

- Reporting Companies Created or Registered on or after September 4, 2024, that had an original filing deadline between December 3, 2024, and December 23, 2024: The new deadline is January 13, 2025.

- Reporting Companies Created or Registered Between December 3, 2024, and December 23, 2024: Granted an additional 21 days from the original filing deadline to file BOI reports.

Frequently Asked Questions on BOI Report

What is a BOI Report?

As the name implies, a Beneficial Ownership Information (BOI) report generally provides details about the owner and individuals who directly or indirectly control a company.

Who is required to File BOI?

Generally speaking, the following companies are required to complete the BOI reporting:

- Domestic Entities: Any domestic company that complies with US tax regulations is considered a domestic entity. This covers limited liability partnerships (LLPs), corporations, and LLCs.

- Foreign Entities: These are entities created outside of the United States and conduct business in the United States.

Who is a beneficial owner?

The beneficial owner of a reporting company is defined as an individual who either directly or indirectly:

- exercises substantial control over the firm, or

- owns at least 25% of the firm’s ownership interests. Examples of ownership interests include equity shares, stock, voting rights, or any other mechanism used to establish ownership.

How do you define a company applicant?

A company applicant is a person who submits entity formation forms with a state, tribal, or other U.S. Jurisdiction. This person may be the company's business owner or someone else, such as a lawyer or CPA. The reporting company can list up to two company applicants.

A "company applicant", in short:

- the person who directly submits the document that creates or registers the reporting company, and

- If more than one person is involved in filing the document, that person is principally responsible for directing or controlling the entire filing process.

Are there any penalties for not filing the BOI Reports?

Yes! The Corporate Transparency Act's FinCEN rule specifies non-compliance with the BOI reporting requirements will result in civil penalties of up to $500 per day. In addition, a $10,000 fine and up to two years in jail are part of the criminal penalties.

Helpful Resources For BOI Filing

BOI Reporting Requirements

BOI Filing Instructions

BOI Report for LLC