Benefits Of Filing Form 940 With 123PayStubs

IRS-Authorized 940 E-file Provider

Easy-to-use Dashboard

Instant IRS Filing Status

Lowest Price in the industry

Accurate Calculations

Built-in Error Check

Review Form Summary

Make Corrections before filings

Download & Print Forms

How to File Form 940 Online for 2024 Tax Year?

Step 1: Enter Form 940 Information

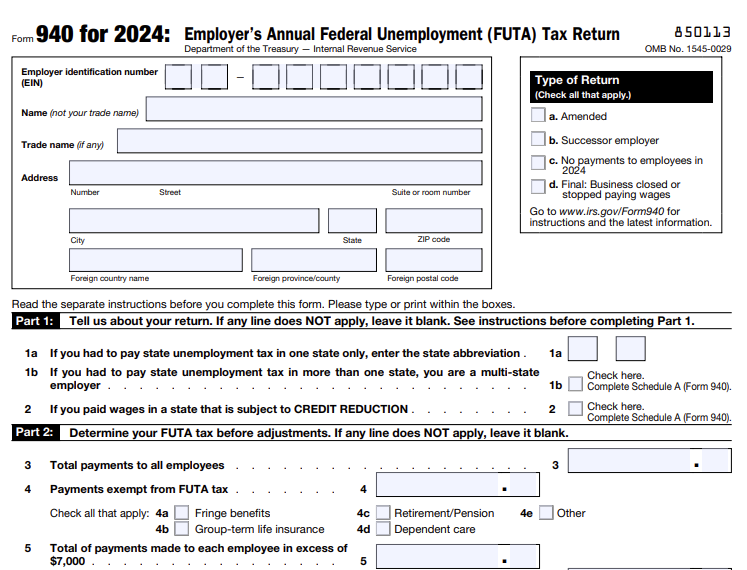

To begin filing Form 940, you will need to have your basic business information on hand. This includes information such as your business name, legal address, and Employer Identification Number (EIN). You will also need to have the total payments made to all of your employees as well as your employer-share of FUTA taxes. You will also need information regarding your FUTA liability deposits.

Step 2: Sign Form 940

To complete Form 940, you will need to sign the return using a 94x online signature PIN or Form 8453-EMP.

Step 3: Review & Transmit to the IRS

After completing all of the necessary fields on Form 940, you should review your form for any errors or missing information before transmitting it to the IRS. Once the form is transmitted you can download or email it from the dashboard.

Frequently Asked Questions on Form 940

What is Form 940?

Form 940 is the Employer’s Annual Federal Unemployment (FUTA) Tax Return. Form 940 is used to report Federal Unemployment Tax Acts (FUTA) taxes to the IRS.

What are the changes in Form 940 For 2024 Tax Year?

For the 2024 tax year, the credit reduction rate for California, Connecticut, Illinois, and New York is 0.6% and for the U.S. Virgin Islands is 3.9%.

Who must file Form 940?

Employers that paid $1500 or more to employees during any quarter of the current or prior tax year are required to file Form 940. Also, employers that hired employees for 20 weeks of the tax year, including full-time, part-time, or seasonal/temporary employment must file Form 940.

When is Form 940 Due?

The deadline to file Form 940 with the IRS for the 2024 tax year is January 31, 2025. If your FUTA taxes are deposited, then it can be filed by February 10, 2024.