Advantages of Filing Form 1099-MISC Online With 123PayStubs

Here are some of the best benefits you’ll get when you choose to e-file Form 1099-MISC through 123PayStubs.

Instant Filing Status

You’ll be notified of your return status by email as soon as the IRS processes your return.

Mail Recipient Copies

Choose our postal mailing option for us to send copies of Form 1099-MISC to your recipients on your behalf.

Form Validation

We will validate your tax returns against the IRS business rules in order to reduce the chances of IRS rejection.

Form 1096

We’ll auto-generate your Form 1096 while you file Form 1099-MISC with us, and you can keep it for your records.

What Information is Needed to File Form 1099-MISC Online?

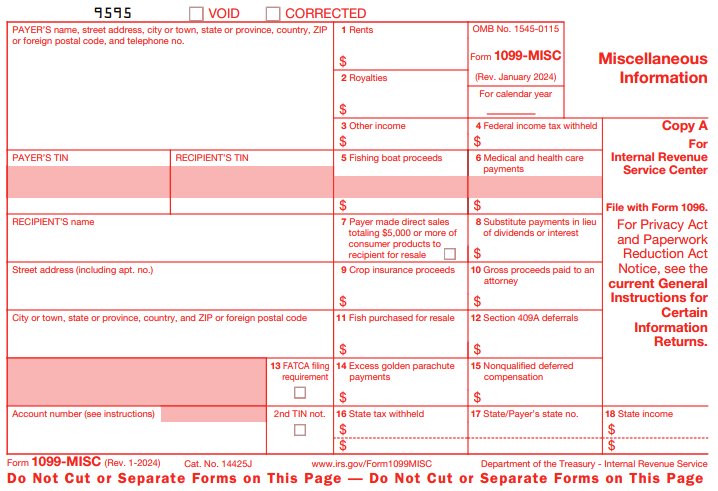

Below is the required information to file Form 1099-MISC online:

- 1. Payer Details: Name, EIN, and Address

- 2. Recipient Details: Name, EIN/SSN, and Address

- 3. Federal Filing Details: Miscellaneous Income and Federal Tax Withheld (if any)

- 4. State Filing Details: State Income, Payer State Number, and State Tax Withheld

Have these details ready? Start filing your Form 1099-MISC in minutes.

How to E-File Form 1099-MISC?

E-file Form 1099-MISC with the IRS through 123PayStubs by following the simple steps below.

1. Fill out Form 1099-MISC

Fill out the form 1099 MISC information including payer and recipient info and federal and state wages info.

2. Review Form

Review form and make sure the information entered is correct. Edit the return if there are any errors.

3. Transmit the Return to IRS

If everything is correct, transmit the return directly to the IRS.

Start filing Form 1099-MISC. It’ll take only a few minutes.

It’s as simple as 1-2-3!

Frequently Asked Questions on Form 1099-MISC

What is IRS Form 1099-MISC?

Form 1099-MISC is used by payers to report miscellaneous payments such as rent, prizes and awards, medical and health care payments, fishing boat proceeds, and other qualified payments.

Ready to file Form 1099-MISC online? Click here to file the return in minutes using 123PayStubs.

When is the deadline to file Form 1099-MISC?

The recipient copies of Form 1099-MISC must be sent on or before February 02, 2026. If you are filing with the IRS by paper, the deadline is March 02, 2026. For electronic filing, the IRS deadline is March 31, 2026.

Are there any late filing penalties for Form 1099-MISC?

The IRS may impose penalties under Section 6721 for Form 1099-MISC due to:

- Late filing

- Filing a paper form that is not machine-readable

- Using an outdated version of the form

- Not submitting the correct copy of Form 1099-MISC

- Filing with an incorrect or missing TIN or reporting incorrect information

If you file Form 1099-MISC late, the IRS penalty is $60 per form if you file within 30 days after the deadline. The penalty increases to $130 per form if you file more than 30 days late but before August 1. If you file after August 1 or fail to file entirely, the penalty rises to $340 per form. Higher penalties may apply if the IRS determines intentional disregard of the filing requirements.

Still have questions about our online paystub generator?

Reach out our customer support team by chat or email for any questions that you may have regarding our paystub generator.